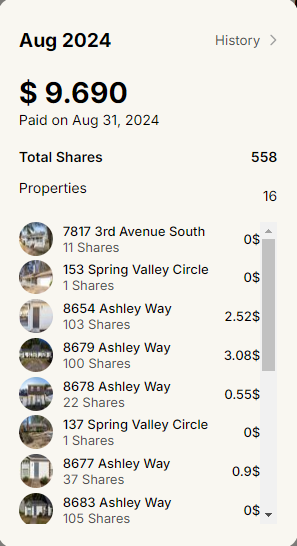

I think the graph speaks for itself. I have had Landa.app for a few years now, and I can confirm that this company is a great way to lose money. Yishai Cohen used the tagline "Real estate investment for real people" to help bring in investments into this company. As most of you know, I was excited but a bit skeptical about Landa.app, and it appears that time has now proved what I long suspected: the only people who will make long-term money on Landa.app are the company itself. Let's break this down and go over what I am personally experiencing.

1. The Dividends

The idea was that by owning a share of the properties, any income generated from the property would be distributed via monthly dividends to the investors. In April of 2022, I purchased my initial six properties, and just like any good scam, the initial months that followed had me excited to see the potential growth from my investment. I utilized a reinvestment strategy and grew my account, despite seeing the cracks forming in the Landa.app foundation, until finally it started to collapse completely.

I started looking into each of the properties I had purchased and realized there was a common problem: Landa.app is the company that manages them. The CEO of Landa is Yishai Cohen. If you look at his Facebook profile, you will see he is politically active when it comes to the Palestine/Israel conflict.

Let's take one of my properties and take a look at it to see what I am referring to.

3. Analysis

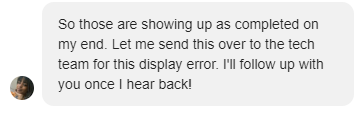

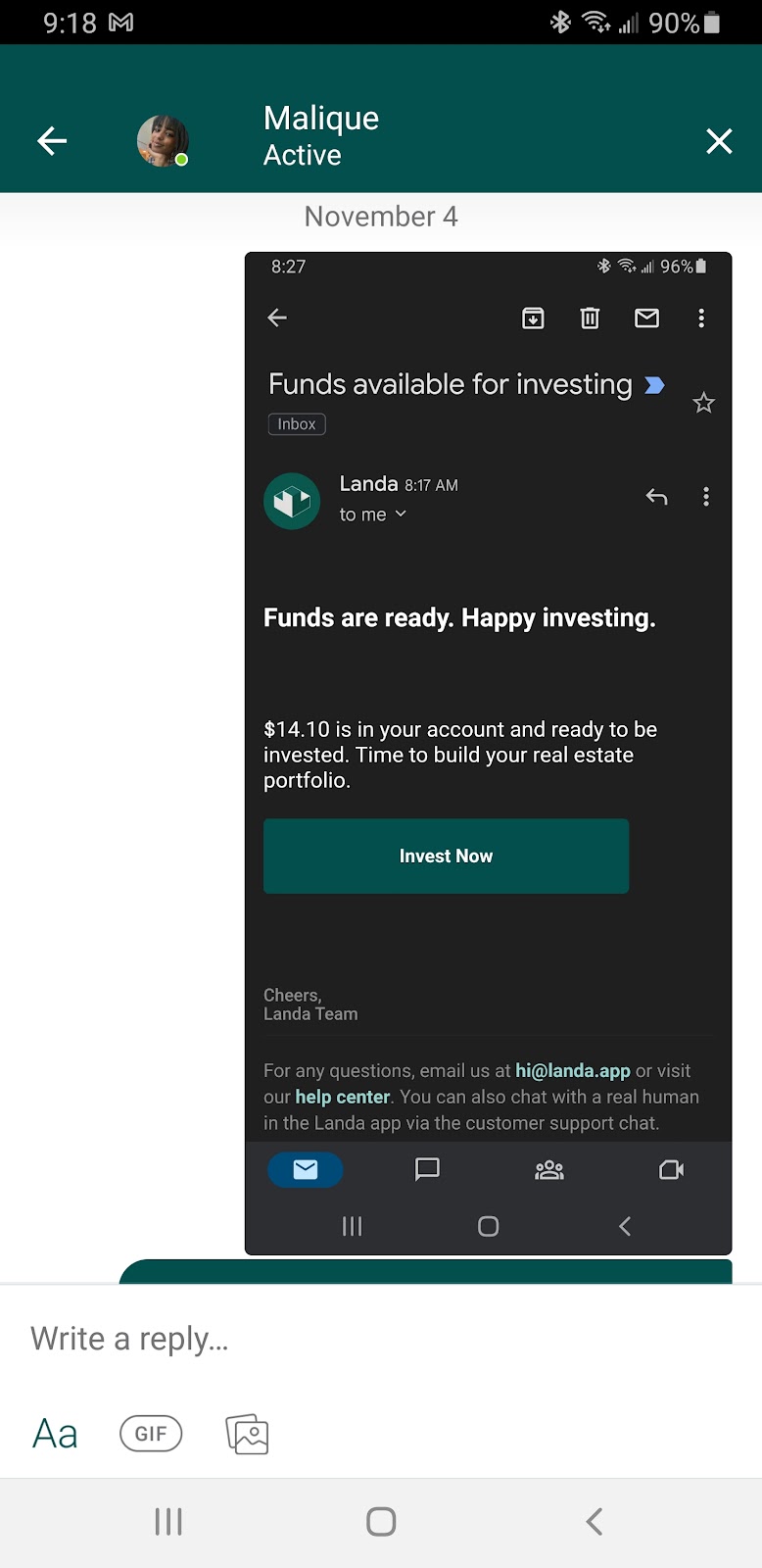

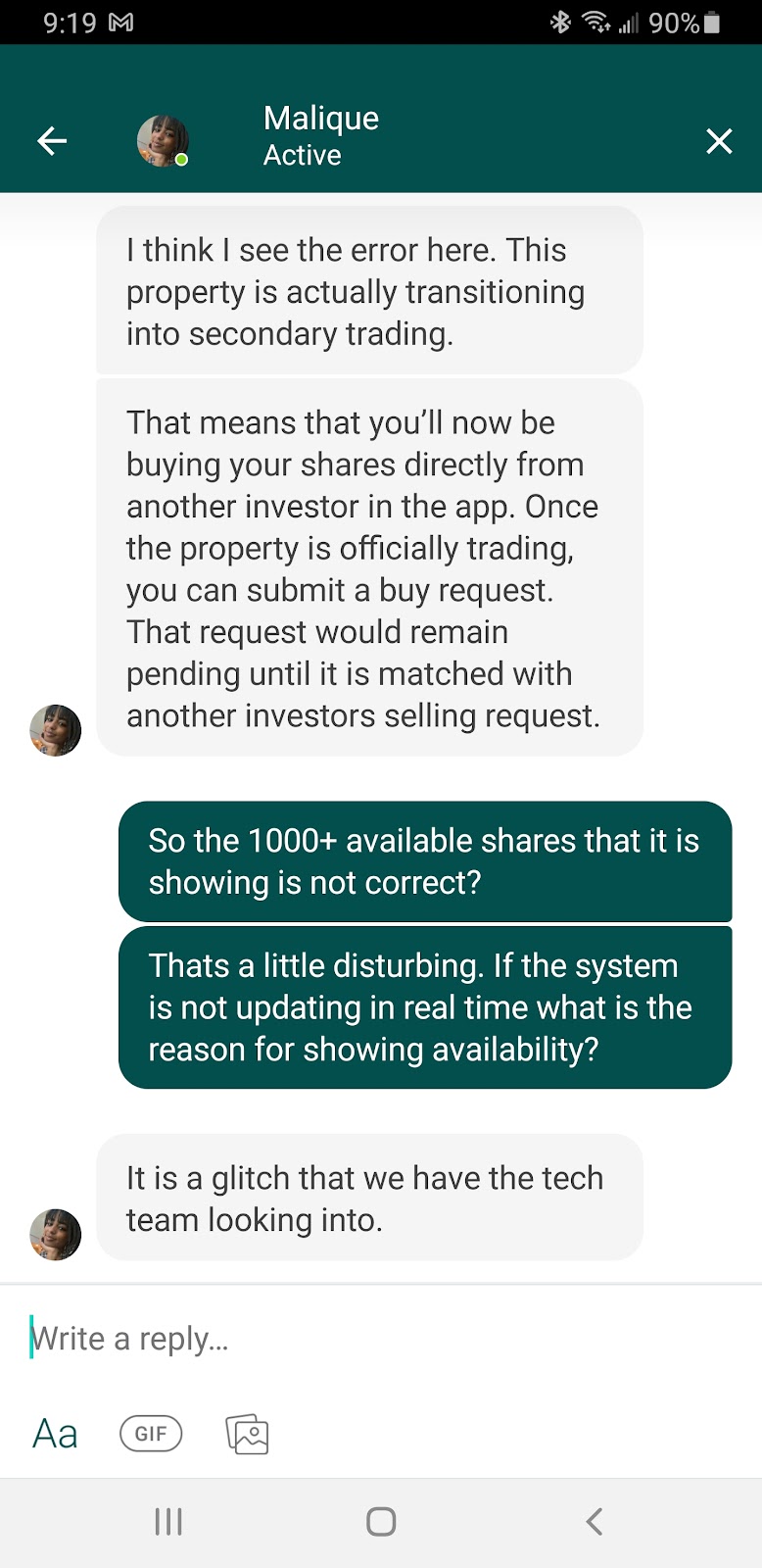

For this exercise, we will use 6696 Mableton Parkway SE, but most of the others all follow a similar pattern. First and foremost, Landa.app is not great at providing information on the financial portion of how a property is doing. As an example, you can see from the following screenshots that there are items marked as missing. This is concerning because it has to do with money, and when information about financial items is missing, it leads one to wonder if there is some illegal activity happening. Per this graph, after March of 2024, things begin to start getting questionable.