November 16-2022

I have been using Landa now for multiple months and have grave concerns with the way it conducts business. I am starting to feel that Landa has some very serious issues with how this company is run. I have come to the realization that the company's intention is not to sell properties to everyone but instead wants to boost its membership base numbers. You might ask why would a company do something like this, and the answer is simple. Landa is attempting to prove that it is a legitimate company through the use of membership numbers. After all, how could a company with dividends distributed to over 30,000 members be bad?

Let's start off with the process of buying properties. As I have already demonstrated in other posts, Landa has been limiting my purchasing of properties that would have a higher return rate. There have been times when the limit was very straightforward, and it was obvious they did not want me to purchase additional shares. I am going to provide an example of straightforward property denial in a screenshot from the app below.

As you can see from the text, this property appears reserved within the property pool to act as bait to draw in additional subscribers. This is a key to my point that Landa's goal appears not to be selling properties but acquiring additional users of their app. This one is a very straightforward way of preventing people from purchasing properties but, I have experienced multiple other ways of preventing me from acquiring properties with a more subtle approach.

As you can see from the text, this property appears reserved within the property pool to act as bait to draw in additional subscribers. This is a key to my point that Landa's goal appears not to be selling properties but acquiring additional users of their app. This one is a very straightforward way of preventing people from purchasing properties but, I have experienced multiple other ways of preventing me from acquiring properties with a more subtle approach.

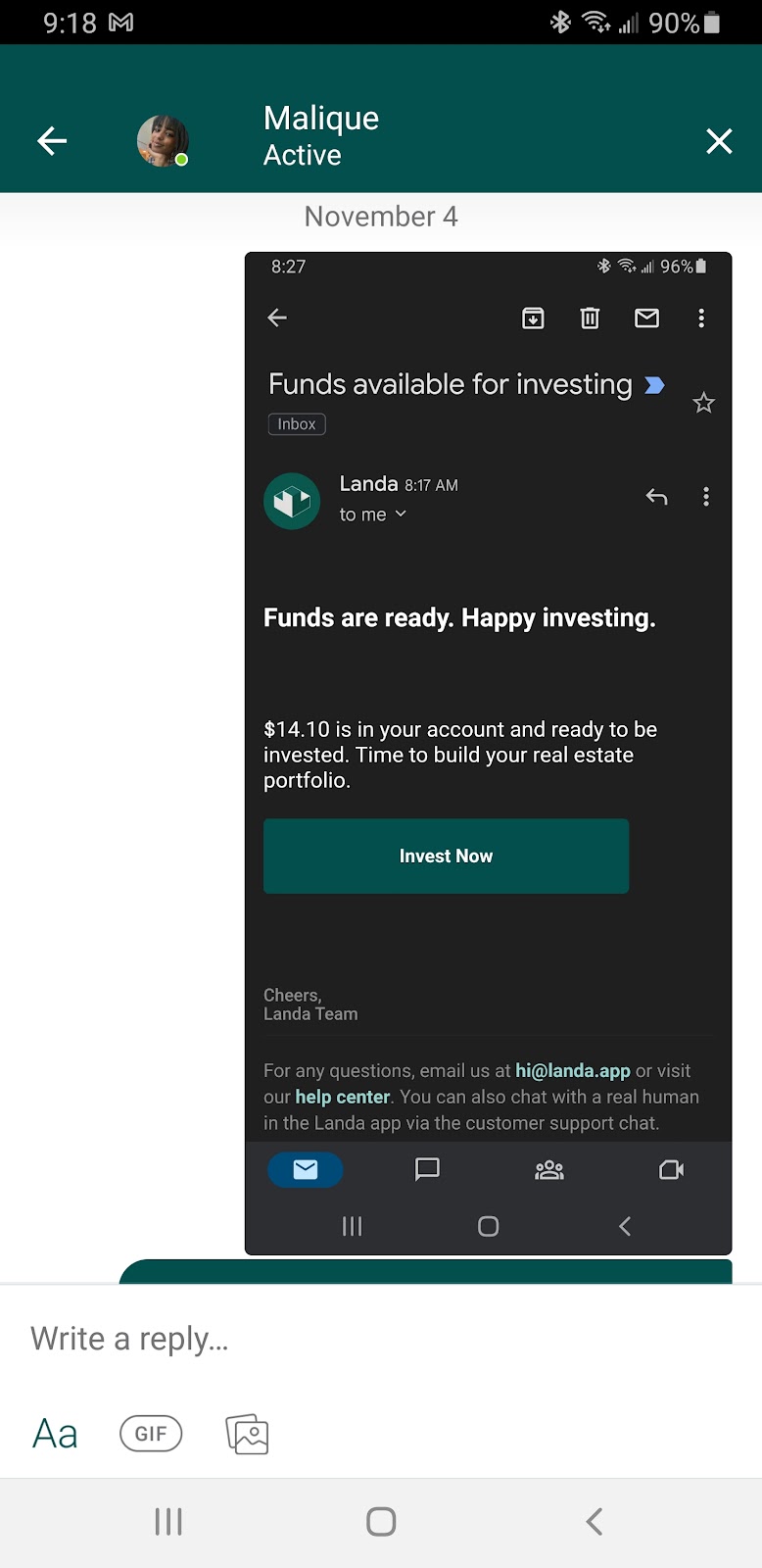

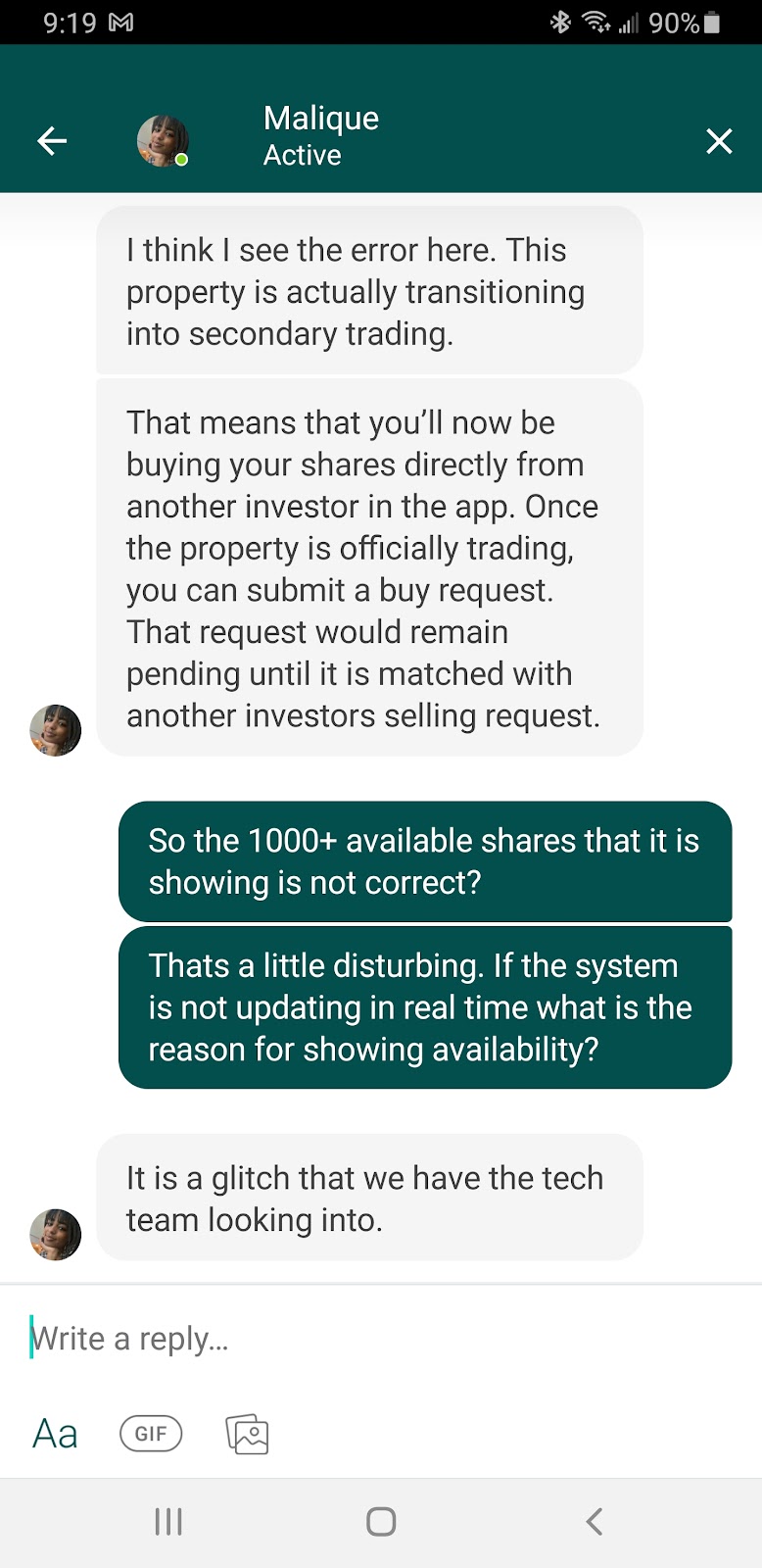

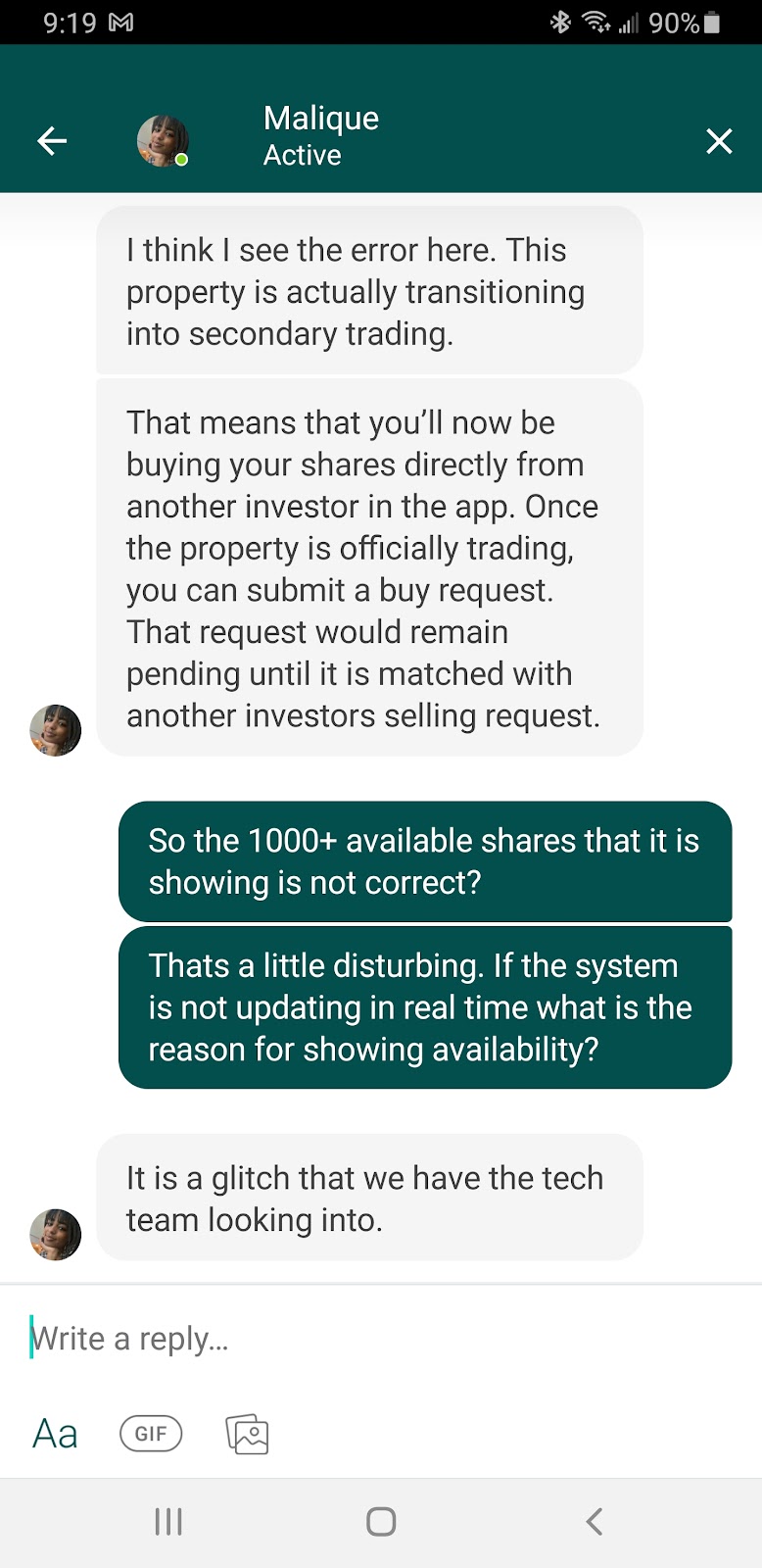

Take for example my recent attempt to purchase 2 shares of a property whose rent payments would provide roughly a 5% dividend rate (as opposed to the 1% rate of the other available options). I was informed by Landa that my previous month's dividends were ready to re-invest so I moved forward with this purchase. I attempted to get 2 shares, and as you can clearly see the site is showing that there are 1762 shares available. This failed, so I reached out to Landa support and received a response that I think are just a canned response.

As you can see I had the cash in my account and attempted to purchase a property. Landa simply blocked it and pretended that it was a software glitch. You can clearly see there were plenty of available shares, but the purchase did not go through. I have multiple other instances of other purchases that had similar results, where a technical glitch prevented me from obtaining the property that I was attempting to purchase. Some of the other screenshots I have contained sensitive information so I can not include them here, but I can provide a small example showing where one of my purchases indicated that the funds had been sent, yet I never did receive the property. I ultimately had to cancel the transaction after trying to run the clock out.

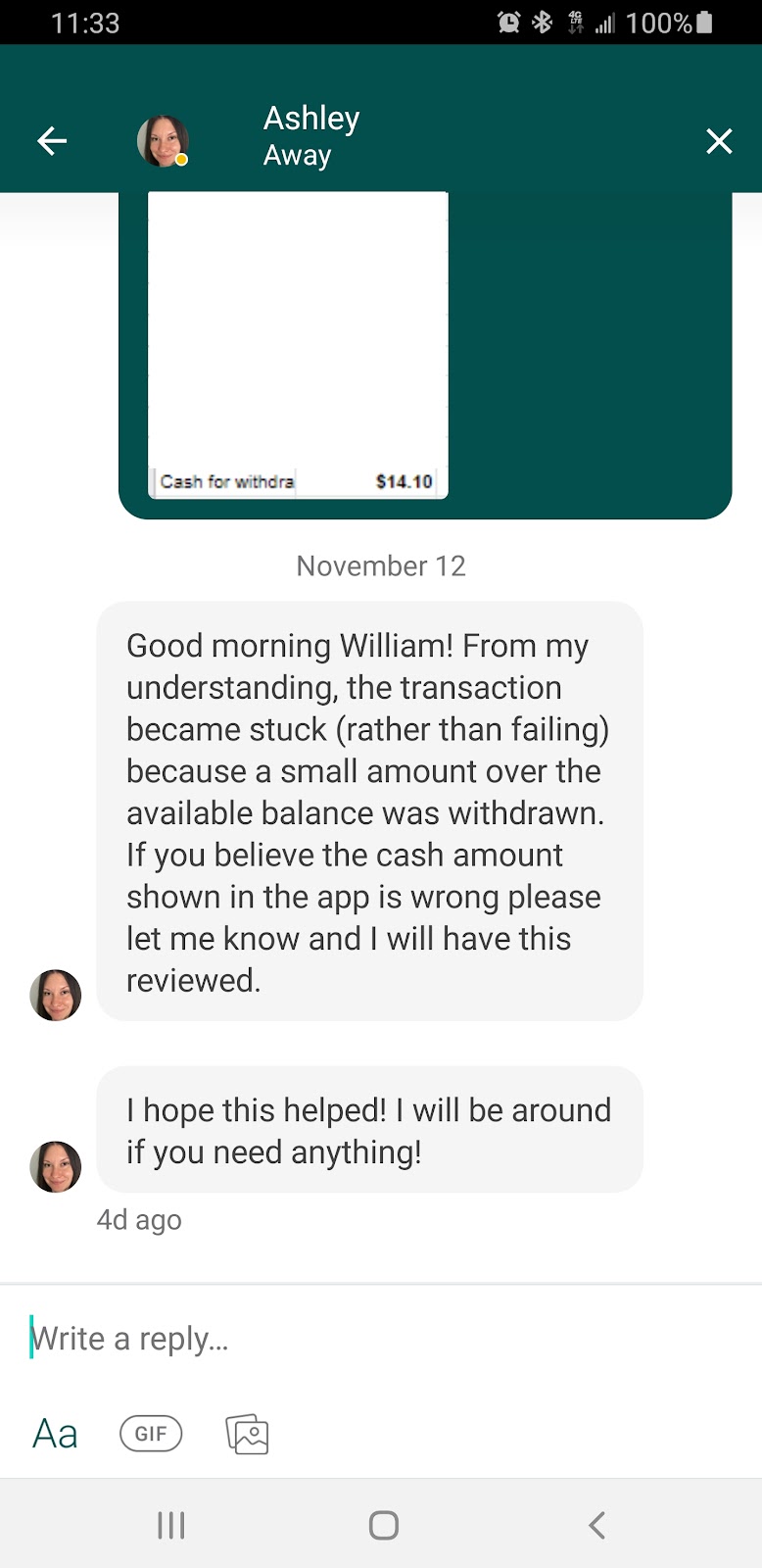

Once I finally gave up on purchasing additional properties, I decided it was time to just pull the dividends out of Landa, and start looking for other places to keep my returns. This is where things got very scary. Landa had another Glitch that prevented my withdrawal request from going through. That's right, I could not pull the funds that I had made via the dividend out into my bank account. I reached out to support, and it dragged on for about a week before I was asked to cancel the transaction as part of the bug that they found.

I did cancel the withdrawal, and the amount that ended up in my account was -.20 less than the amount shown in the account prior to the withdrawal attempt. This prompted me to run through all of my Landa transactions, and as of this wrighting, my total vs Landa total is .09 different. This is eye-opening because it tells me 2 things. The first takeaway is Landa app accounting is not to be trusted. The numbers that they provide are not correct, so keeping a separate personal Ledger is highly important. The second key is, the software is full of bugs. Landa does not provide any type of useable ledger, that you can download and validate against personal records, and I suspect that this is by design. Consider this, if something were to go south, and Landa ended up in court the lack of transparency would help them.

Let me finish this post, by sharing my personal thoughts on Landa. Regardless of the trouble, Landa has with their application and my fear that ultimately the company will end up disappearing I plan on continuing investing and growing my Landa profile. Some of you may ask why would I do that and I can only share a line that a good friend of mine uses "Sometimes you have to risk it for the Biscuit". My goal has always been passive income, and there is high risk with investments that provide over a 10% return. I am willing to take that risk in hopes that I am wrong and Landa is around for a long time. I will be creating a separate post that will share the gains or losses I have made with Landa as a way of sharing with the community. My goal is simple, and that is to generate passive income, and at the moment Landa is enabling me to do this.